missoula property tax map

The MSL reserves the right to change or revise published data andor services at any time. Remember to have your propertys tax id number or parcel number available when you.

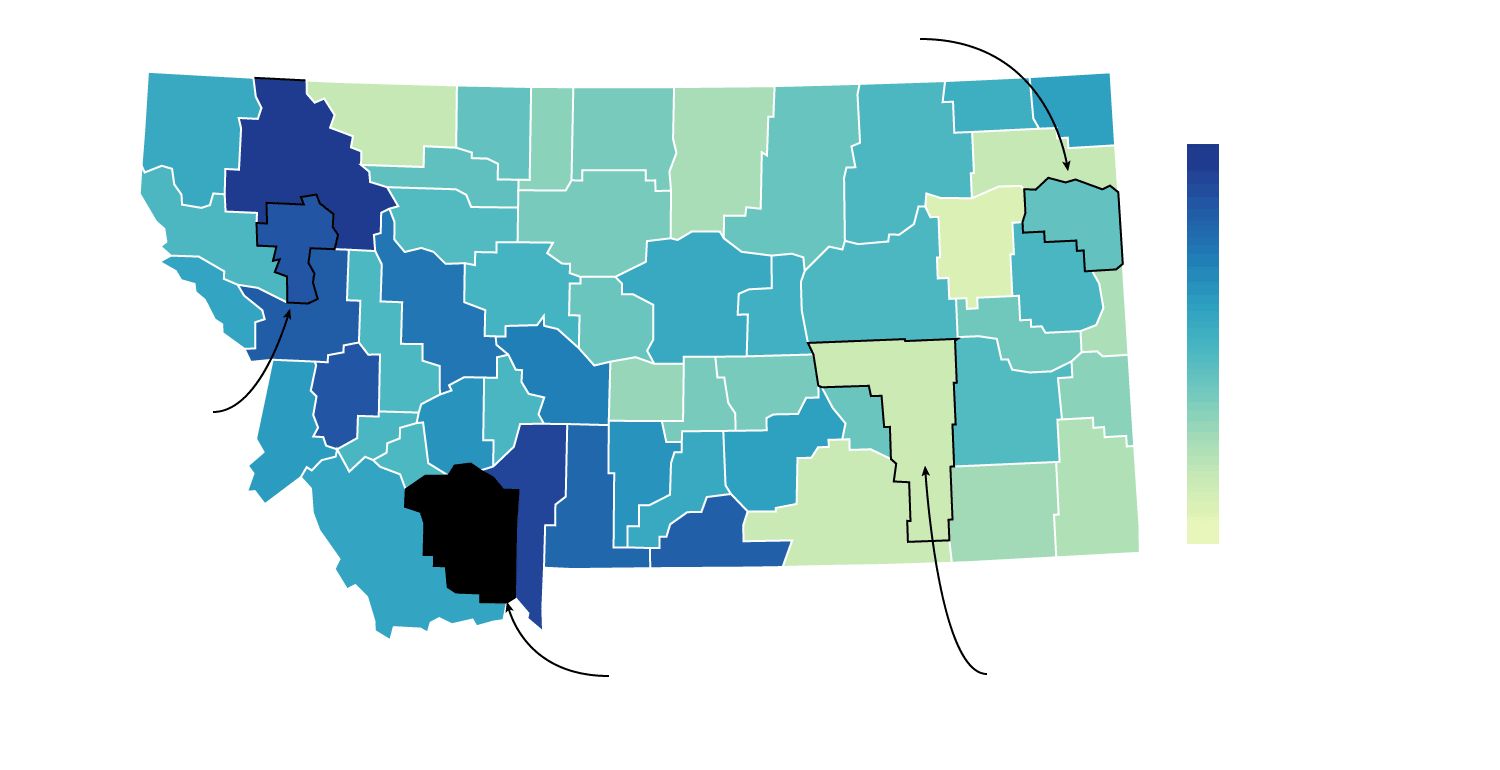

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

The Property Information System is an online resource that can be used to view most of Missoula Countys GIS data.

. Learn more about your appraisal notice and protest options from the Montana Department of Revenue. The Missoula Treasurer located in Missoula Montana is responsible for financial transactions including issuing Missoula County tax bills collecting personal and real property tax payments. Welcome to the Missoula County Property Information System.

Missoula County has one of the highest median property taxes in the United States and is ranked 374th of the 3143 counties in order of median property taxes. Ad Find Out the Market Value of Any Property and Past Sale Prices. Property tax assessments in missoula county are the responsibility of the missoula county tax assessor whose office is located in missoula montana.

A library of maps can be found here. There are a variety of GIS layers and base maps to choose from in the Layers Tab on the. 1515 East 6th Avenue.

Charles County to a low of 34800 in Shannon CountyFor more details about the property tax rates in any of Missouris counties choose the county from the interactive map or the list below. Missouri has 115 counties with median property taxes ranging from a high of 237700 in St. The MSL makes these data and services available as a convenience to the public and for no other purpose.

To ensure the correct parcel is paid the Parcel Number is the recommended search method. Tyler Technologies - iTax. The property information system can be searched by applying.

If using Internet Explorer 11 be sure the Compatibility View is checked. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. You can call the Missoula County Tax Assessors Office for assistance at 406-721-5700.

Missoula county collects on average 093 of a propertys assessed fair market value as property tax. Missoula County Treasurers Office Missoula MT 200 West Broadway Street 59802 406-258-4847. The median property tax in missoula county montana is 2176 per year for a home worth the median value of 233700.

Search Any Address 2. Missoula Countys Property Information System provides a variety of features for citizens and businesses conducting searches related to property ownership. If you have documents to send you can fax them to the.

All groups and messages. Missoula Countys Property Information System provides a variety of features for citizens and businesses conducting searches related to property ownership. Missoula County is linking to the State of Montanas CAMA Computer Assisted Mass Appraisal data specific to Missoula County residents.

The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. Get In-Depth Property Reports Info You May Not Find On Other Sites. JONES STEVE or JONES Property Address.

Missoula property tax system. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Missoula County is not responsible for the content provided by the State of Montana.

Use only ONE search field at a time Parcel Number. Missoula County collects on average 093 of a propertys assessed fair market value as property tax. Missoula County plat maps also contain important information for prospective buyers about flood zones easements rights of way and public access.

The value of your property directly affects the property taxes you pay to schools. The notices for the 2019-2020 appraisal cycle are mailed in June 2019 with a 30-day protest period. The cost of printed andor custom maps is dependent upon the fee schedule.

Check the characteristics of your property with the property report card locate property using the statewide parcel map review the certified values of property in your county or area find tax exempt property in each county and. Many maps are available in print and pdf format. Missoula MT 59802 Phone.

The property information system can be searched by applying any of the following criteria. The link is based on property Geocode. Tax auction information including upcoming tax sales property descriptions and auction information in missoula county montana may be on the treasurer and tax collector website.

The Missoula County Treasurers Office located in Missoula Montana is responsible for financial transactions including issuing Missoula County tax bills collecting personal and real property tax. This code identifies the property in Missoula County. You are visitor 4705307 The value of your property directly affects the property taxes you pay to.

The Missoula County Treasurer and Tax Collectors Office is part of the Missoula County Finance Department that encompasses all financial functions of. The Missoula County Treasurer and Tax Collector may provide online access to plat maps on its website. The property information system can be searched by applying any of the following criteria.

This MONTANA CADASTRAL MAPPING PROJECT is maintained by. Missoula county has one of the highest median property taxes in the united states and is ranked 374th of the 3143 counties in order of median property taxes. Please contact us for more information.

The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. See Property Records Deeds Owner Info Much More. Missoula property tax map.

Missoula Countys Property Information System provides a variety of features for citizens and businesses conducting searches related to property ownership.

Home Property Missoula County Mt

7520 Parkwood Drive Missoula Mt 59808 Mls 21906348 Listing Information Berkshire Hathaway Homeservices Montana Real Next At Home Luxury Property Sapele

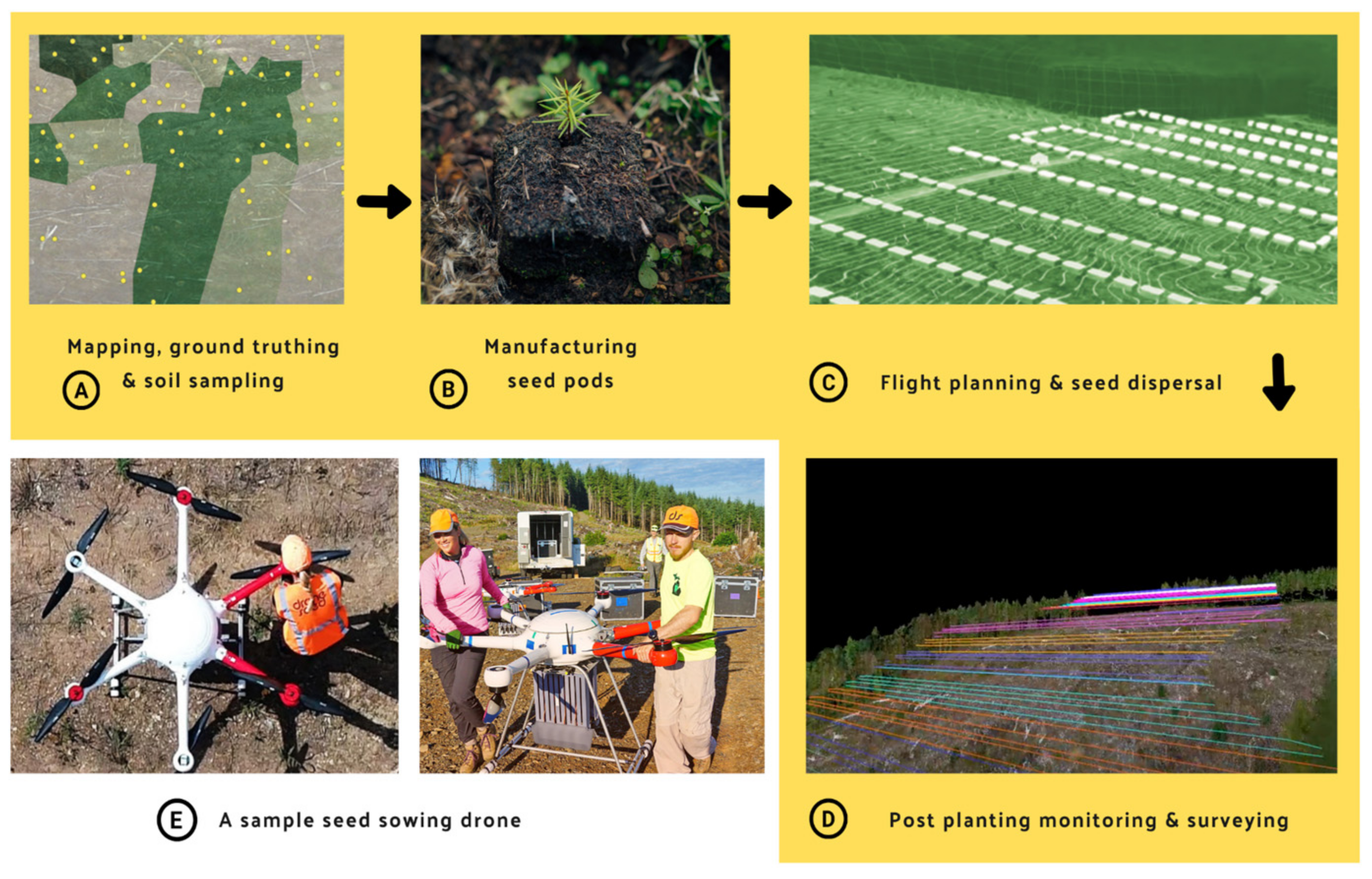

Remote Sensing Free Full Text Uav Supported Forest Regeneration Current Trends Challenges And Implications Html

Alabama Fairhope 541 Falling Water Blvd Mls 622002 Waterfall Fairhope House Styles

You Can Make 110 000 Flipping A House In Maryland Here Are The 10 Best States To Turn A Profit Flipping Houses Wyoming South Dakota

Love The Cabinets Kitchen Home Home Decor

Where Do People Pay The Most In Property Taxes In The Us Property Tax This Is Us Map